In this article you are going to learn about a simple technique to forecast future revenues as a factoring broker based on your existing portfolio of prospects.

In this article you are going to learn about a simple technique to forecast future revenues as a factoring broker based on your existing portfolio of prospects.

This technique is useful because it allows you to determine, at the beginning of a month, the approximate revenues that you will earn from your efforts. And more importantly, it helps you evaluate whether your sales efforts are working as well you’d like.

Setting up Revenue Tracking

This method of forecasting is based on the simple premise that history repeats itself. More importantly, it assumes past performance is an indicator of future results. The fact is that for most of our businesses, the recent past is a good indicator of what will happen in the near future. In this case, we are only going to use this tool to forecast the number of deals and expected revenues out of your current base of prospects. This is relatively simple and can be very useful if you need to get an idea of the monetary value of your current prospects.

A small warning. Reading about math can be a little difficult, but the math itself is very easy. I have included a table at the end of each description to show how the setup looks. Once you look at these tables, you’ll see that this process is relatively easy to do and won’t take you more than a couple of minutes.

To set things up, you will need to do two things. First, you have to organize your leads based on their lifecycle stage. For this example, we are going to use three possible deal stages. They are called:

- Application: Means that a client has received or submitted application.

- Proposal: Means that a client has received or returned a proposal.

- Contracts: Means that a client has received their contracts and is reviewing them.

The second step is to look at your past deal performance and determine the closing rate at each stage. This can be tricky because it requires going over past data. But it’s worth it.

For example, your past performance may show that once you have an application, there is a 10% chance that the deal will close and fund in that month. Likewise, if you get the deal to the proposal stage you may find that you deals have a 30% chance of funding in that month. And if you go as far as sending out legal documents, you may find that your deal has a 50% chance of funding. By the way, your numbers may differ. I am using made up numbers for this example.

What do you do if you don’t have past performance data? Use an educated guess for the first month and keep refining your estimates as time goes by.

Once you have this information, the next step is to build a table with your summary deal information in it. You will need to determine how many deals you have at each stage and figure out their combined monthly volume. The following table shows the setup, and hopefully clarifies it.

![]()

This table shows that there are 10 deals in the application status with a combined potential monthly factored volume of $800K. Note that the total volume is basically the sum total of what you estimate each prospect will factor on any given month. The table also shows that you have 4 deals in the proposal stage with a combined volume of $300K. And lastly, it shows that you have 2 deals in the document stage with a combined volume of $200K.

With this in mind, the next question is obvious.

How Much Money Will These Factoring Deals Make Me?

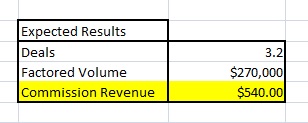

Calculating your expected commissions is fairly easy, especially if you use a spreadsheet. To calculate your total number of expected deals you multiple the number of deals in application status by their closing rate. So, 10 deals times 10%, equals 1 deal. You do the same thing for the deals in the proposal and documents stage, and then add up the numbers. In this case, it comes up to 3.20. You would expect to close that many deals this month.

The next step is to calculate your forecasted factored volume. You follow the same exercise as we did in the previous paragraph. You multiply $800K by 10%, $300K by 30% and $200K by 50%. Again, you add the numbers and get $270K. That is the volume that your 3.2 deals will factor per month, on average.

Now we get to the important question. How do you calculate your expected commissions? You do this by multiplying $270K by the average factoring rate in your portfolio and by your average commission rate. Assuming a 2% factoring rate and a 10% commission rate, you get $540.00 in expected revenues. Don’t forget that these revenues will be recurring, since the above information was based on monthly data, you’d get $540 per month out of these deals.

Limitations

Unfortunately, some aspects of revenue forecasting can be as accurate as fortune telling, especially for brokerages. In my experience, I have found that this tool is quite good at providing me the approximate number of deals that I will close on any given month. It is less accurate at forecasting the factored volume and the expected revenues from brokerage commissions. There are a couple of reasons for this. The most important one is that large deals tend to throw your numbers off. For example, you could have 10 deals in the application status with a total of $800K. However, $400K could be tied to a single deal with the rest spread among the other 9 prospects. You know you have a 10% chance of closing one of those deals, but there is no certainty as to which one will close.

Why is this useful?

This tool is useful for the simple reason that it provides actionable information. It’s also easy to do and can be completed quickly. At a high level, it can let you know if your business is producing the number of deals that you need. And if you keep some of your old forecasts you can also use them to see if any trends are developing. At a more complex level, you can also use this tool to analyze sales channels as part of an effort to optimize your factoring commissions.

Perhaps, its most important benefit you get from this tool is not in the data that you get. Rather, building a forecast forces you to review your business processes and take a careful look at where you are right now. This can help you figure out if you are going down the right path, or if you need a course correction.

About the Author:

Marco Terry is the managing director of Commercial Capital LLC and Commercial Capital LLC (Canada), a leading factoring and purchase order financing intermediary. He can be reached at (877) 300 3258.

Great article on factoring, the company website is pacted with good educational information

Can you tell me if the company works with consultants?

Thanks

Tom

Hi Tom –

Thanks for your kind words.

Best,

Marco