You may have walked out of meetings with bankers, accountants, and CPA’s thinking you were at a “financial disadvantage” as they danced their fingers across a financial calculator and reported their results.

You may have even wished you could “crunch the numbers” yourself for peace of mind or to make sure no one was taking advantage of you.

If either of those situations sounds familiar, then you need to learn how to use a financial calculator. There are some great books and training materials out there, but you first must start with the calculator itself.

You want something that can efficiently calculate credit lines, mortgages, notes, investments, and loans with ease – well, there are plenty to choose from.

The big question now is, “Which one?”

Many calculators can handle financial functions and some are much easier to operate than others. Here is the top four used in our industry. If you want avoid the technical stuff just skip to the bottom and discover what we use personally!

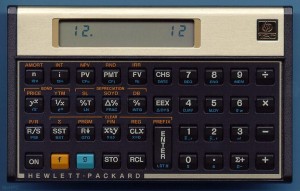

Clearly the industry’s front-runner, the HP12C was THE standard for anyone in real estate for years and can still be found in most investor’s desks.

The HP12C is very powerful but comes with some initial challenges. You may have noticed that it does not have an “equal” sign. The HP uses Reverse Polish notation so 1+1=2 would be calculated as 1 [enter] 1[+] (then you get the answer of 2?). The catch here is that if you don’t already know how to use one, it may be worth skipping on to the next model.

The newest model has six times faster speeds for calculating TVM, loan payments, interest rates, standard deviation and more. Work more efficiently with memory for up to 80 cash flows. Ideal for real estate, finance, accounting, economics and business work. The HP 12C Platinum Financial Calculator is a classic!

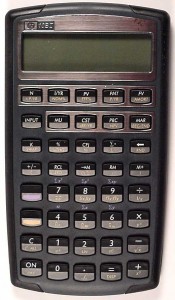

Probably the most basic of the financial calculators, the HP10B (now the HP10B-II) or the TI BA-II Plus will get the job done.

Created in competitive nature, both deliver the basic needs of a financial calculator. Along with the standard capabilities of time-value-of-money, accrued interest, amortization, cost-sell-margin, and depreciation, users will calculate more advanced business and finance related issues.

If you are wondering what exactly the “plus” buys you in the TI BA II Plus model, you have to look pretty close (initially the only extra things found were keystrokes). The BAII Plus does allow differing compounding periods to payment periods. You can even calculate bonds to call as well as yield.

With that said, for basic workhorse calculators, you can’t go wrong with either the Texas Instruments BA II Plus Professional Financial Calculator or the HP 10bII Financial Calculator.

Texas Instruments Financial Analyst

Texas Instruments Financial Analyst

This out of production calculator is still a favorite and worth keeping an eye out for at local garage sales and eBay.

In addition to great speed, the TIFI has a large screen that is capable of holding up to four different calculations simultaneously (Column A, B, C, and D).

Additionally, the TIFI can easily amortize any cash flow and give you the balance at any given point in time.

So, what calculator do we use personally?

Well Tracy always grabs the HP12C while I prefer the TIFI (yes a house divided). When teaching workshops we typically gravitate towards the HP10B due to the affordability and ease of use for new learners.

No matter which calculator you choose, the time spent learning the calculator will no doubt be worth it! Going forward you will save time and money, but perhaps more importantly have better control of you cash flow.

Hey very nice blog! finance courses (Lauren) like best example!