Many people have heard about the cash flow industry but don't really know how the average person can profit from it. There are basically three methods for handling the fees paid to cash flow brokers or consultants, as follows: Referral Fee Establish Your Own Fee Set Commission Fee 1. Referral Fee Pros: Very Little Paperwork/Time. Cons: Typically smaller commissions. Cash Flows: Just about any cash flow can be "referred." The Referral Fee structure is the easiest, particularly if you already have a full time job and you have limited extra hours in the day. With the Referral Fee structure you simply find a deal and refer it on to a Funder or Master Consultant that accepts referrals. For the most part, you have no or … [Read more...]

Archives for November 2009

Can a Company Use Accounts Receivable Funding If It Already Has a Bank Line of Credit or Tax Liens?

Many times a company thinks if they have an existing bank loan or line of credit they will not qualify to sell their receivables. In some cases a company may still be eligible to work with a full-service factor and realize the benefits of factoring. … [Read more...]

Factoring Demand Increases as Big Business Takes Longer to Pay

Dealing with cash flow strain in a struggling economy, big business is taking longer to pay on invoices. The average time to pay bills is up 5% to 55.8 days for companies with sales over $5 billion, as reported by the Wall Street Journal in Big Firms Are Quick to Collect, Slow to Pay. … [Read more...]

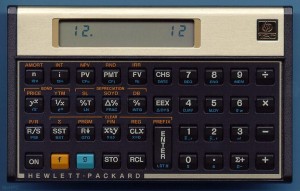

Level the Playing Field by Learning How to Use a Financial Calculator

You may have walked out of meetings with bankers, accountants, and CPA's thinking you were at a "financial disadvantage" as they danced their fingers across a financial calculator and reported their results. You may have even wished you could "crunch the numbers" yourself for peace of mind or to make sure no one was taking advantage of you. If either of those situations sounds familiar, then you need to learn how to use a financial calculator. … [Read more...]