Well-known for its online payment processing, PayPal™ is now venturing into the world of working capital funding for businesses. The new financing program is geared towards small business owners and publicized as an alternative to traditional bank loans.

Well-known for its online payment processing, PayPal™ is now venturing into the world of working capital funding for businesses. The new financing program is geared towards small business owners and publicized as an alternative to traditional bank loans.

We have been using PayPal™ here at Factoring Investor to accept payments online in the Bookstore since we first started publishing our newsletter online in 2008. We are familiar with its ease of use and secure processing. The part that came as a surprise was their recent marketing email touting similar benefits to factoring invoices. Here is a quick excerpt:

If you’ve been thinking about growing your business with PayPal™ Working Capital, we’re here to help.

It’s easier funding for anything your business needs.

Purchase inventory, launch a new product, seize new business opportunities, or expand your marketing budget.

The materials went on to expand upon additional benefits including:

- Quick Funding Time

- Single Fixed Fee

- No Periodic Interest Charges

- Credit Checks and Financial Reports Not Required

- No Personal Guarantee

- Early Payoff Without Penalty

- Doesn’t Impact Your Personal or Business Credit Score

Sounds a bit like a list of invoice factoring benefits doesn’t it?

So How Does The PayPal™ Working Capital Program Work?

Business account holders can receive an advance based on the monthly invoices collected and paid through the Pay Pal™ processing system.

Eligibility

Offered exclusively to PayPal™ business customers.

Loan Amount/Advance

The PayPal™ sales history determines the loan amount available. Generally a maximum is set at 8% of the volume processed by PayPal™ in the past 12 months.

Repayment Schedule

There is no set payment date. Payments are due only on days with sales and are automatically deducted from the PayPal™ account.

Payment Amount

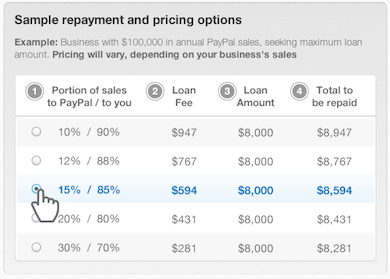

The amount of repayment is a percentage of sales for that day (if any). The percentage is set as part of the initial agreement. Sample percentages provided ranged from 10 to 30% of daily sales going to repay the loan.

Loan Fees

The fee is a fixed amount that is determined upfront. It is based on the loan amount and the daily repayment percentage. Selecting a higher percentage results in a lower fee. While the lending program is determined individually here are several samples included in the marketing materials.

Sample Transaction with a 10/90 Split

A business with $100,000 annual sales seeks a loan of $8,000 and a repayment percentage of 10% to PayPal™ (90% to business). The loan fee is $947 with a total repayment of $8,947.

Sample Transaction With a 30/70 Split

A business with $100,000 annual sales seeks a loan of $8,000 and a repayment percentage of 30% to PayPal™ (70% to business). The loan fee is $281 with a total repayment of $8,281.

Term

A business can reapply for another loan when the balance has been paid in full.

Will The PayPal™ Working Capital Program Impact Invoice Factoring Companies?

Factoring involves an advance on invoices for goods and services that have been delivered and most of these invoices are not paid through PayPal™. Since the PayPal program is only available to companies that process payments and invoices through their online system it should have a negligible short term affect on the factoring business. It is more likely to compete with merchant cash advance companies that allow businesses to leverage their future credit card sales.

So why the interest?

PayPal™ is huge! They process almost 8 million payments every day. In 2012 they processed $97 billion online and in stores. This year they expect to process $20 billion in mobile payments alone!

They are global. PayPal™ has 137 million active accounts in 26 currencies and 193 markets around the world.

They have connections. You might have heard of eBay? Well PayPal™ is an eBay company that contributed 40% of their revenues in 2012.

When a company that large starts offering alternative financing options to business owners it’s good to pay attention to what might come next.

*PayPal™ is a registered trademark of PayPal, Inc. This article was written based on public information at PayPal.com. This author, company, and website are not endorsed by or affiliated with PayPal, Inc.

Speak Your Mind