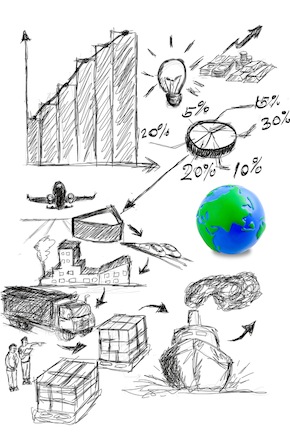

Discover how Purchase Order Funding and Factoring can provide full service financing for your clients.

How often has it occurred that you have prospected for factoring clients, and when it came time to qualify your lead, they really needed a finance product that provided funds before the creation of an invoice?

We know first hand that such situations are very common. We’ve even had the situation where we sent out a proposal and the applicant replied that they needed up front funding, not invoice factoring, even though we fully explained at the start that we did factoring.

It was soon after that event when I realized that factoring and purchase order (PO) funding are closely related and the two products can offer referral sources additional income and a steady flow of business.

Purchase Order Funding

PO funding is a financial product that “reaches back” to pay for goods or commodities provided by a client’s vendors. Let’s follow the chain of events in an imaginary “full service” transaction.

Our client, the seller of widgets to Wal-Mart, Marshalls and Target is not the manufacturer. The manufacturing takes place in China and our client purchases and imports the fully manufactured widgets to the U.S by boat.

The order of events just described is vital, since the manufacturer needs to be paid before anything is exported out of China (imported here). Our client must pay for the full container of widgets so he can get them to the U.S and truck them to his three customers. Our client is not buying this product to keep in inventory, but rather to deliver immediately to fulfill the three purchase orders he received from his three customers. Each purchase order confirms that the customer will buy the product once delivered if the product meets the specifications on the PO. Such specifications may be amount, sizes, colors, and other quality control details.

Our client has not yet issued any invoice to be factored, so where is the money coming from in order to pay for this shipment? That is where the PO Funder comes to the rescue.

The PO funding company will evaluate the transaction and once satisfied, will pay to the manufacturer 70% of the PO value or the full cost of the goods, which ever is less. (This structure is just for this example only, each transaction stands on its own and may be structured differently).

Prior to paying for the shirts, the PO funder will have an inspection of the shipment to make sure that the PO has been fully satisfied and the widgets conform in every way, to the specifications on the PO. Once approval is confirmed, the funder releases the payment to the Chinese manufacturer and the product travels overseas to the U.S.

The Invoice Factoring Component

The shipment arrives, gets another inspection, and is trucked to each customer. Upon delivery, an invoice is presented to the customer (Wal-Mart). At that time, the invoice gets funded (purchased) by the factor, in a process that:

a) pays off the PO funder for what he paid to the Chinese manufacturer, plus fees, and

b) sends the remaining part of the factoring advance to our client. You know the rest, once the invoice is paid in 30, 60 or 90 days, our client gets the balance of the invoice value less the factoring fee.

One obvious point that must be addresses is that the PO funder gets his fee and the factor gets his fee. Our client better have enough margin to sustain these fees or the profit will be little or none. In his underwriting, the PO funder considers the margin as high priority.

Qualifying the PO Funding and Factoring Transaction

This type of transaction is typical, and we should examine the different parts so that we understand how to qualify a transaction.

- First we notice that there is a clear and irrevocable PO issued by a creditworthy customer.

- Second (and VERY IMPORTANT) we see that our client who sold the widgets did not have to add any other process or enhancement to the product.

- Third, we see that the PO funder paid directly to the manufacturer of the widgets and did not pay more than the cost price of the widgets. Also remember that there was a pre-shipping inspection done before the PO funder paid for the product and before it was shipped.

- Finally upon delivery to the customer an invoice was issued. If the invoice had extended terms (net 30, 45, 60 etc.) a factor purchased the invoice and paid off the PO funding company.

This funding strategy pays for the product manufacturing, and pays the invoice once delivered. In many cases our client will not have to advance any meaningful amount of money to get the product from manufacturer to customer. As a broker you have virtually arranged funding for the client’s entire cycle of business.

Full Service Purchase Order Factoring

The value of these two funding processes rolled into one fluid transaction recently attracted our attention to the point where we joined forces with a well experienced purchase order financing company. Now, Xynergy Capital Group and Claro Trade Finance are one company, offering the ability to execute PO finance, and when needed, to provide the invoice liquidity for the factoring component.

Think of being able to provide full service to your clients in this manner. Many distributors fall into the need to pay for product that is already pre-sold and do not have the financial ability to put that process together. We certainly want to be your source for these transactions!

About Fred Leder: Xynergy Capital Group is a factoring finance company located in south Florida, with nationwide clients and referral sources.

About Fred Leder: Xynergy Capital Group is a factoring finance company located in south Florida, with nationwide clients and referral sources.

For more information contact Fred Leder at (954) 519 2376 or by email at fleder@xynergycapital.com. You can also visit the company website at xynergycapital.com.

You may also enjoy these additional Invoice Factoring articles by Fred Leder:

- Top 10 Accounts Receivable Factoring Questions

- How To Build Your Factoring Business In 2013

- IRS Issues Do Not Kill All Factoring Transactions

- The Financial Professional’s Vocabulary