Wondering how to start or grow a small business factoring company?

Based on two decades of experience, Jeff Callender shares his tips for factors and brokers including why he prefers small invoices, how to avoid his biggest mistakes, and what he would do differently if he started all over again. Get all the details in this exclusive interview from FactoringInvestor.com!

Based on two decades of experience, Jeff Callender shares his tips for factors and brokers including why he prefers small invoices, how to avoid his biggest mistakes, and what he would do differently if he started all over again. Get all the details in this exclusive interview from FactoringInvestor.com!

How did you get started in small business factoring?

Jeff Callender

I left my previous career in 1992 and was looking for a business I could run from my home. I stumbled on what was then the International Factoring Institute, which later became the American Cash Flow Association. In January of 1994 I took the training to become a factoring broker.

However, I wasn’t very successful at that because many of the clients I found were too small for factors to accept back then. In August of that year I started funding one of these very small clients myself, and found it suited me better than brokering. So I gradually took on more very small clients, and realized I had stumbled onto a very nice and untapped niche – micro factoring. I figured out a model to make it work that didn’t fit larger factors, and have been doing this and writing about it since.

Did you find it hard to discover information about factoring when building Dash Point Financial?

In the 1990’s there was almost nothing written about factoring at all. However, when I started thinking about buying receivables myself, I found a booklet on the internet (such as it was then) that talked about making income by buying receivables. The information was very simple and short (about 40 pages), printed with a dot-matrix printer on typing paper, which was put in a college-type plastic term paper folder…and cost $50!

As I read it I realized this was something I could do, and also realized that writing a real book about factoring could generate some interest. After all, there was nothing else written about factoring for the public and I paid 50 bucks for this! So after I had been working the business for about a year I set about writing my first book, Factoring Small Receivables. I’ve updated that book seven times since 1995, and its newest edition title is How to Run a Small Factoring Business ,which has just been released.

What was the biggest mistake you made when starting your factoring business?

Mistake? Singular? I’ve made so many mistakes, not just when I started but regularly all along the way, I could write a book. Actually, come to think of it….

Seriously, I’ve written my books so that others could avoid the mistakes I’ve made (as well as to make the country more aware of factoring). There’s a full chapter in How to Run a Small Factoring Business about nothing but mistakes I’ve made or seen others make. It’s called “24 Common Mistakes,” and there’s a battle scar from every one.

Seriously, I’ve written my books so that others could avoid the mistakes I’ve made (as well as to make the country more aware of factoring). There’s a full chapter in How to Run a Small Factoring Business about nothing but mistakes I’ve made or seen others make. It’s called “24 Common Mistakes,” and there’s a battle scar from every one.

The new Factoring Case Studies book has contributions from eight small factoring colleagues and describes both good and bad clients they’ve had. There are 30 case studies total, and as you read it you see the mistakes these factors made as they worked with the problem clients. I think Case Studies provides the most practical education and training in the series, and is my personal favorite. It also has a lot of humor in it.

If you could begin all over again what would you do differently?

Well, that’s hard to answer because so many things have changed in two decades. However, if I were to mention one thing, it would be that I would be more cautious than I was when I started.

I’m a very trusting person by nature, and I tend to believe people more readily than is sometimes wise. In this business, you must trust people to a degree, but it is crucial you make sure what you’re buying is not only legitimate, but that the account debtors have received the goods or services, intend to pay without any issues or offsets, and will send the money directly to you, not the client. These are nothing new to seasoned factors, but they are the most important things you must do get your money back consistently.

I didn’t do this carefully enough when I started and got burned many times. That can happen to any factor, but the more careful and methodical you are about getting paid, the more you make.

Why do you think smaller invoices are better for factors?

Well, they’re not better for everybody, but because they are smaller, more people can be small factors than can be large ones. While you need some capital to be a factor of any size, you certainly don’t need millions if you focus on micro factoring. Also, because most larger factors don’t buy receivables from very small clients, smaller factors can charge a bit more and thus make a higher return on investment.

Very small factors’ potential for severe loss is also less. While most people can absorb a few small losses as a micro factor, one big loss can wipe you out. No matter what size factor you are, keeping your concentrations low is absolutely crucial to avoid catastrophic loss. When a factoring company of any size goes out of business, it is almost always because it is over concentrated in one or a few accounts that go south, often in a brief period of time.

Do you find a greater risk of default in factoring small or large clients?

Small, though there is risk in both. The very small clients I work with (we fund only companies factoring $10k or less to start) are usually unsophisticated at running a business, and make some unwise decisions. However, owners of larger businesses certainly make bad decisions too.

The difference is, when my clients do something wrong, unwise, or fraudulent and it causes me to lose money, the amount I lose is much less than the big guys. However, small losses with small clients tends to happen more frequently than large losses with larger clients.

As a factor, you have to accept the fact that such events go with the territory and if you can’t stand to ever lose money, being a factor is not for you.

Are there any industries you specifically avoid or find attractive?

As a micro factor I work with a lot of Mom & Pop operations in a variety of industries, many of them providing a service. These include janitorial and other cleaning companies, security guard companies, small staffing companies, and so on. We also work with small manufacturing companies and others who make or sell products. In short, we fund many small service or manufacturing companies that have invoices to credit worthy companies and/or government agencies that will send their payments to us directly.

There are some industries we don’t fund: construction, medical receivables paid by insurance companies, Medicare/Medicaid, or private parties; international receivables, and trucking receivables (though many small factors specialize in trucking). We also try to avoid insurance companies and most property management companies as account debtors, as we haven’t had positive experiences collecting from them.

Why did you write the series of factoring books?

I saw an opportunity. I couldn’t believe there was virtually nothing written about factoring when I entered the field, and knew I could make a contribution.

While the first book I wrote was well accepted, I knew there was more to the business than could be covered in just one title. A few years later, I had the time to write more. So I decided to take on other topics related to factoring, and in the early 2000’s added an introductory book called Factoring Fundamentals. Many readers said they needed more marketing information, so I addressed that topic with the book Marketing Tools. I also knew prospective clients needed more information so wrote a book for them.

I’ve always found case studies to be a great learning tool, and added the first Factoring Case Studies book to the series. Finally I took brief clips from each book and other material I’d written, and compiled them into Factoring Wisdom, which is a great introduction and summary of everything.

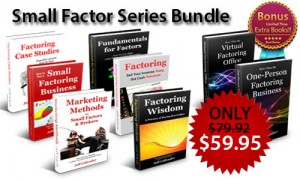

In the last couple years I’ve been working on major updates or complete re-writes of all these books. I’ve just released them in 6 titles, which are available on FactoringInvestor.com. The names of most of them are new, but they are grounded on the original material. The new titles are:

1. Factoring Wisdom

2. Fundamentals for Factors

3. How to Run a Small Factoring Business.

4. Factoring Case Studies (2nd edition)

5. Marketing Methods for Small Factors & Brokers

These are the books that now make up the Small Factor Series. A sixth book, the one written for prospective clients, is also available – Factoring: Sell Your Invoices Today, Get Cash Tomorrow.

If someone wanted to learn more about small business factoring where do you suggest they start?

Many of my books are written precisely for this audience. They can buy them right here from FactoringInvestor.com as PDF ebooks, as well as in paperback from www.DashPointPublishing.com, Amazon, and other online bookstores.

Also, next year I’ll be providing a new online training program called The Small Factor Academy. It will be completely web-based learning and will utilize the above books as well as numerous training videos to teach people how to be small factors.

Great interview!

I have read:

Factoring Wisdom

Factoring Case Studies (2nd edition)

Marketing Methods for Small Factors & Brokers

They were very informative and helped me tremendously in

starting out as a factoring broker.