Most brokers who join the factoring industry expect to eventually own a factoring company. They plan to start as brokers due to the lower cost. This approach allows them to get some revenues and experience, with the hope of eventually becoming a full-fledged factoring company.

Most brokers who join the factoring industry expect to eventually own a factoring company. They plan to start as brokers due to the lower cost. This approach allows them to get some revenues and experience, with the hope of eventually becoming a full-fledged factoring company.

This strategy is fine, as long as you realize that running a factoring company is completely different from running a brokerage. The costs, needed skill set, risks, rewards, and challenges are very different.

Do you have the capital?

The first question to ask yourself is if you have sufficient capital to start factoring accounts. This attainment is not as easy as it sounds. Obviously, you need enough capital to service your clients.

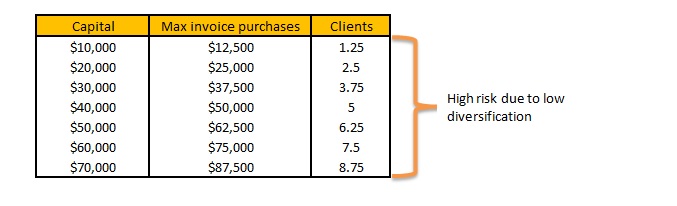

This simple table gives you an idea of how many invoices you could buy with different levels of capital. The ”Clients” column shows how many clients you could have with $10,000 of utilized funds (at any given time) assuming an 80% advance. Keep in mind that this table is simplified.

Can you manage the risk?

One of the main challenges of running a factor is managing risk. On one hand, you need substantial capital to secure enough clients to spread the risk around. On the other hand, having just a couple of clients can be hazardous because a single default could wipe out your profits – or your capital.

To add complexity, you need to balance your portfolio to ensure that it does not include clients who are so big that their default would devastate your portfolio. This balancing act can be challenging. Letting go of a profitable client because they outgrew your credit limits is one of the toughest lessons to learn in the factoring industry. Unfortunately, the industry is full of failed factoring companies who were unable to balance these risks and rewards.

Do you have the legal and financial knowledge?

To be a successful factor, you need a certain level of legal and financial knowledge. You should also work with an attorney familiar with factoring law.

Additionally, you should consider looking for an industry mentor. Having a mentor is critical, as they can offer assistance when you are faced with difficult decisions. As I have mentioned in previous articles, I learned the factoring business from Jeff Callender. I recommend that aspiring small factors read all his books.

Do you have the right personality?

Being a successful factor requires a specific personality. One thing that is for certain is that you will run into clients who will try to defraud you. Many won’t succeed, but some will, and you may take a large financial hit. You must be able to work with those situations while keeping yourself levelheaded. This approach sounds easy in theory. In practice, however, it’s a lot harder when a fraud deal wipes out your quarterly profits – or your company.

Do you have the time?

Although you can run a small factoring company in a few hours per day, you need to work every day. Unless you have staff, you need to be available through holidays and during vacation time. This commitment can be very demanding, and you may find that clients are not very understanding. Taking a vacation is doable – but difficult.

Factor small clients; broker the big ones

Lastly, if you decide start a factoring company, consider starting small. Broker large accounts, and factor the small deals as you learn the ropes. Then, grow your company as your industry experience increases.

Interested in learning more? Read the second article in this series on How To Finance Your Factoring Company.

About Marco Terry

About Marco Terry

Marco Terry is the managing director of Commercial Capital LLC and Commercial Capital LLC (Canada), a leading factoring and purchase order financing intermediary. He can be reached at (877) 300 3258.

I was the first Liquid Capital franchisee / licensee and lost everyrhing. Now I am vwry happy as a broker.

Martin – Thanks for sharing. Being a factor is tough business. I would agree that for many – being an intermediary is a much better option.

–Marco