For a factoring broker, selecting the right factoring companies to work with can spell the difference between being successful in the business – and never closing many deals.

Yet, most brokers don’t have a well thought out process to choose their factoring partners. Instead, they chose their factors based on the broker compensation package or how well they clicked with their broker representative.

Yet, most brokers don’t have a well thought out process to choose their factoring partners. Instead, they chose their factors based on the broker compensation package or how well they clicked with their broker representative.

While these two criteria are important – they are among the least important criteria to select a factor. Actually, if you select a factor just based on compensation, you could end up losing money. Let me tell you a story.

The reality of broker compensation

When I was starting my factoring career I was faced with a difficult choice of selecting partners. One factoring company had a great plan, but offered low broker commissions. The other one had a much less attractive plan but offered substantially higher commissions.

Actually, the commissions where 50% higher.

I decided to work with both but I had a feeling that the lower commission factor would be better at closing deals and produce more revenues in the long term. Therefore, I decided to send them the majority of my deals.

To many brokers, that decision may be counterintuitive. Why not send the leads to the factor with the much higher compensation package and hope for the best?

Simple, I would have made less money.

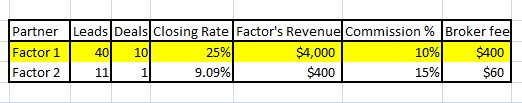

Let me show you an example of how this can work. Assume that each deal produces $400 in monthly revenues to the factor. Factor 1 is the low commission factor with a great finance program. Factor 2, on the other hand, is the high commission factor that has an average program. Now, let’s see what happens if I send the majority of the leads to factor 1. As the following table shows, they produce $400 worth of commissions.

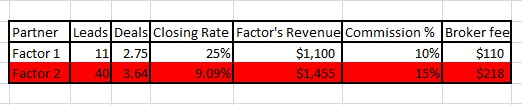

But what would have happened if the tables got turned and factor 2 got most of the leads? After all, they have the high commission package. I decided to play a “what if” scenario and change the lead assignments. Obviously, the closing ratios are left unchanged. The following table shows what would have happened to the revenues.

Factor 2 would have only generated $218 in commissions. A loss of $182 (45%) in potential revenue! While I changed the numbers for this example, these two tables reflect exactly what happened to me. This is why selecting the right factoring partner can be so critical for your business. The right factor can increase your revenues. The wrong one can cost you dearly.

Now, let’s go back to the original question…

How do you select the right factoring partner?

First, understand your market.

Before going through the exercise of interviewing and selecting factors, you first need to understand your market. You need to think about who your prospects are, their financing requirements, and what does the factor need to offer to fulfill them. Each market has different needs and requirements and therefore no single factor can be good in every market.

This leads me to the next point. There should be no “one size fits all” factoring companies in your portfolio. You don’t want that! You want specialist companies that are superior to their competition in what they do. In the end, you want to recommend the factoring company that best fits your client. This is a very important. Recognizing it will help you close more deals and book higher revenues.

Once you have a good idea of your target market, the next part of the process is to select your factoring partners. Now it’s time to start talking to your potential partners and learning about their companies.

The Critical Question – What is their unique selling proposition?

Usually one of the first questions that I ask when I interview a factor is “what is your unique selling proposition? How are you different from every other factor that is out there?” Then, I shut my mouth and let them speak. How they answer this question is critical for me because it tells me how well they understand the market and how they fit in it.

Unfortunately, many factors answer this question with generic answers. These provide very little value. Not because the factor isn’t good – but because the factor is not showing how they are different. For example, many answer by saying that “they offer the best customer service in the industry”. Others say that they can get a “proposal quickly – often the same day” or that they are “the most responsive to client needs and the most flexible”. I have three problems with these answers. First, every factor makes the same claim. Second, this doesn’t make them unique (see first concern). Third, and perhaps the worst offender, these are things that you would expect any professional factor to do as part of giving good service to a client anyways. I mean – let me ask you. Would you work with a factor that didn’t offer these to clients?

Better answers are always filled with specifics. Let me give you some examples. One factor I work with is a specialist in cable contractors. They understand all the billing procedures and are familiar with the nuances of each account debtor. Now that is a good unique selling proposition, if your target market is cable contractors. Let me give you another one. I work with a factor that understands the construction industry and can work with their challenging milestone based billing procedures. Again, that is a great unique differentiator, if your client base is in construction.

But you get the gist; you want to work with companies that are better than others at factoring specific clients and industries.

How do their programs work?

The next thing you want to do is to find out about their processes and programs. This is fairly routine and this is where you find out about their qualification criteria, their rates, their advances, their application process and so on. As a broker, you should be very familiar with this part already. But if you aren’t, just ask the factor to take you through the process from application to funding.

Making the choice

Once you have interviewed the companies, selecting your factoring partner is a matter of selecting the company with the most competitive offerings, the best plans, works well with you, and offers the highest compensation.

Keep things confidential

One last point, during this process you will learn a lot about your potential factoring partner. You will learn about their strengths and weaknesses. You should always do your best to keep this information to yourself, even if they don’t make you sign a confidentiality agreement. This is a sign of professional respect.

About the Author:

Marco Terry is the managing director of Commercial Capital LLC and Commercial Capital LLC (Canada), a leading factoring and purchase order financing intermediary. He can be reached at (877) 300 3258.

The biggest problem I have with this article is that it was written by a factor and I don’t mean this to come across as offensive. The impression I got when reading the article was that it was written by an independant individual who was relating their experiences working with several factoring companies. Factors get a lot of new business from brokers/consultants who decide where to go by the size of the referral fee. Their client has no idea that this is the case and ends up where the broker has placed him so the choice discussed in the article is a choice made by the intermediary and not the client and here I am talking generally. The other point is who is paying the intermediary. If it is the client then you are working for the client and you should have the best interests of your client in mind at all times. If you are a broker for a particular factoring company and are getting a commission from the Factor then you are working for the factor and the client should be aware of this for obvious reasons. If you are getting paid by the client and the factor then you are double dipping. You can’t work both sides of the fence. Double dipping is a serious problem in the industry and if the Factor cares then he will declare commissions paid on closing which prevents the client paying twice for the introduction. My question is do Factors care?

Hi Colin –

Thank you for your comments. I’d like to add a clarification. The first one is that an important portion of our volume comes from acting as an intermediary / broker. This article was written from that perspective and the hope was to outline how we select factoring partners for that part of the business.

Regarding your comment that many brokers direct clients to the factor that pays the highest fee, you are probably right. But that is a losing strategy! You should always place a client with the factor that is best suited for them. And as a broker, you leverage your industry experience to help the client make a proper selection. By placing the client with the best factor, you improve your chances of getting a happy client who will benefit from your services.

Best,

Marco

Marco – I disagree with a few of your ideas. If the broker isn’t closing more deals and still getting paid higher then they simply haven’t found the right company to broker to. That is the bottom line. I think a good broker just needs to keep looking to find all three things. They should get equally: 1) a great commission, 2) a great closing ratio, and 3) a great relationship with people that keep them clued into everything that is happening and they enjoy doing business with. Check out our broker programs. I’d love to receive your deals.

Paul DeLuca

@factoringmentor

pdeluca@merituscapital.com

Hi Paul –

Thanks for your comments. Keep in mind that the combination of great commission and great closing ratio is not easy to find. It’s is not unusual to have factors with the most competitive programs, who also pay lower commissions.

Best,

Marco