Most factoring brokers are consummate sales professionals who spend their time talking to small business owners and trying to generate leads.

Brokerages come in all varieties. Some brokers focus on a single leads source, such as referrals, and work that source for all their leads.

Other brokers run more complex businesses that focus on many sales channels at the same time. An example of the latter would be a broker that does networking, cold calling, regular advertising and internet advertising.

Optimizing Leads

The problem is that as sales professionals, most brokers focus on trying to get as many leads as possible, but don’t focus on lead quality.

A better approach is to try and get as many of the best possible leads. This is an important difference, and a strategic decision.

If done correctly, it will allow you to grow your business, without necessarily spending more time or money.

Let’s look at an example. Robert is a factoring broker who works in the industry full time and is focused on getting as many leads as possible from four different sources. Fortunately, he had good record keeping and has kept track of how many leads he got and which leads turned into deals.

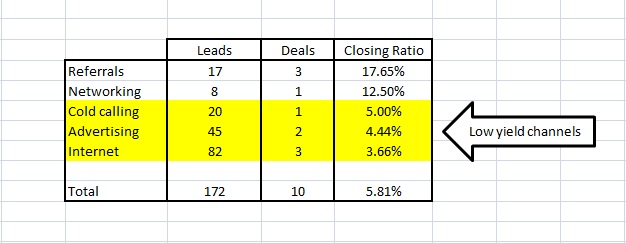

This table shows Robert’s sales activities. The last column in the table is the closing ratio, which is basically leads divided by deals. It shows what percentage of his leads are getting funded.

The first thing that is obvious from this table is that the Robert has two high performance lead sources – referrals and networking. While these produce a low number of leads, they have the higher closing ratios – 17.65% and 12.50% respectively. Compared to his other sources, these two marketing channels are working well.

Now, let’s look at the next three channels. Cold calling, Advertising and Internet ads have yielded 6 deals, but have dismal closing ratios – 5% and lower.

Why is this information useful?

Now, you can focus your efforts on the channels that have the highest closing ratios, and are the most likely to generate deals and income.

Let’s say that you spend 20 hours a week cold calling prospects, but you only spend 10 hours a week going to networking events and cultivating referral sources.

Does that make sense? Not to me!

Twenty hours of cold calling per week only produced a single deal, while the 10 hours of networking and referral sources produced 4. I would spend more time cultivating referral sources and going to networking functions.

Now let’s look at advertising and internet leads. Both these channels have very low performance but also generate a lot of work. They generated a combined 127 leads that you need to place and manage – but only generated 5 deals. That’s a lot of work for just a few deals. Is that the best use of your time? Obviously, the objective is to try and maximize each channel, in order of importance.

Optimizing Closed Deals

We have seen how to optimize your efforts to increase the number of leads that have a high chance of turning into deals. Now, let’s look at the other half of the picture. Let’s assume that Robert works with four different factoring companies.

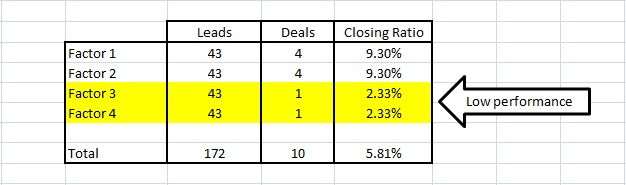

Since Robert is diligent, he is tracking their performance – their closing ratio. Here is how things look:

For simplicity’s sake, let’s assume that each factoring partner got the exact number of leads and the leads are randomly assigned. By the way, some brokers do just that (not a good idea).

The first thing that is obvious is that your two top factors close most of Robert’s deals. They have a 9.3% closing ratio. However, factor 3 and factor 4 have very low performance numbers and have only closed two deals, even though they all got the same number of leads as everyone else. This indicates a potential problem and Robert should talk to Factor3 and Factor4 to try and figure out what is going on. A simple way to optimize the performance of his portfolio might be to send more leads to Factor 1 and Factor 2, and less to Factor 3 and Factor 4.

Putting It All Together For Factoring Brokers

One thing that you should keep in mind is that the examples I used for this article have been simplified. In real life, the numbers will be more complicated and the decisions will be harder to make. Because of this, you should avoid making any rash decisions that have the potential impact your business negatively.

For example, Robert should only dedicate additional resources to networking and referrals to the extent that those additional resources are producing deals. And also keep in mind that having a diverse set of lead sources is often a good idea.

Likewise, Robert shouldn’t change how he is assigning leads to factors until he has viewed the situation in detail and determined why the lower performing factors are not doing well. It could be that the leads he is sending to them are not a good match.

If you follow these techniques, you should be able to increase the number of high quality leads you get, therefore increasing your funded deals and ultimately your revenues. And, you should be able to accomplish these results without necessarily spending more time or money on your business. Just by optimizing, your business will be like a fine tuned engine that is firing on all cylinders.

About Marco Terry

About Marco Terry

Marco Terry is the managing director of Commercial Capital LLC and Commercial Capital LLC (Canada), a leading factoring and purchase order financing intermediary. He can be reached at (877) 300 3258.

Excellent!

Donna –

Glad you liked the article.

Best,

Marco

Very well written. Underscores the importance of having an accurate tracking system in place.!;

Angelo –

You are very right. Having a good tracking system in place is the only way to improve your business.

–Marco

I like the article but there is really nothing here about differentiating one’s self from the competition. I’ve been talking with transportation factors for about six months and when I ask them for the top two things that set them apart, inevitably one of the two is “relationship”. What sets us apart from our competition cannot be the competition’s competitive advantage at the same time. This leads me to think that there is little innovation, nor a desire to say, “These are my closing ratios. What can I do to move them all up?” I believe answering this question is where real profit comes from.

Hi Jeff –

You raise some very interesting points.

1. The article does not cover information on how to market your business or how to develop a value proposition that is different or more attractive than your competitors. It assumes that you already have one. Your point is well taken because all the optimization in the world is *not* going to help you if you don’t have an attractive value prop. Which leads to point #2.

2. I share your experience. Most factoring companies claim that their main competitive advantage/differentiator is their “customer service” and their “relationship management”. This makes it difficult for prospects to evaluate. How do you measure that? However – as an intermediary – you can evaluate that and use it to help your clients. That is an important differentiator for a broker.

Thanks for your comments,

Marco Terry

Marco,

I’m glad I stumbled upon your articles. I’ve been enjoying reading them because you give well thought out advice with examples. Much of what is written out there can be categorized as ‘fluff’, so it’s a real treat to see true, great content.

For me, the obvious follow up question to this article is: What tracking systems do you use? At what granular level do you record data about your marketing activities –> referral partners –> networking groups –> leads –> closed business?

Regards,

Steve Ontiveros

Hi Steve –

Thanks for your kind words. I use Salesforce to track my leads. However, most CRM systems would probably work fine for this. I keep deal metrics based on lead source, which allows me to go very granular in my reporting. This is key if you want to optimize your sales pipeline.

I kept this article high level and simple. But I think there will be a follow up where I go into actual optimization techniques.

Best,

Marco