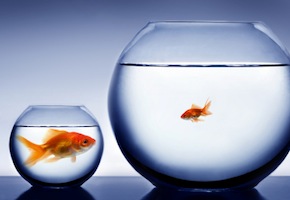

It seems wherever you turn it is difficult for the small business owner to get the same financial flexibility afforded larger companies.

It seems wherever you turn it is difficult for the small business owner to get the same financial flexibility afforded larger companies.

More and more small businesses are realizing that the process of factoring is not out of their reach.

There are many reasons a small business will turn to factoring. Oftentimes they are not able to get reasonable lines of credit through banks due to invoice volume or assets.

A small company, with less than $12,000 per month in accounts receivable, is often financially at the mercy of those paying the invoices. Any late payment can significantly jeopardize a small company’s operation.

Fortunately there are small business factoring specialists that have stepped up to fund companies that would otherwise be overlooked due to:

- Business less than two years old

- Current credit or tax issues

- Prior Bankruptcy

- Low or small balance receivable volume (too low for a large Factor to consider)

With these new ‘Small Factors,” a small business can realize the benefits usually reserved for the ‘big boys.” Benefits such as:

- Increased cash flow

- No incurred debt

- Increased purchasing power

- Improved credit rating

- Professional collection services

If your company has less than $12,000 per month in invoices, you might want to look into a Factor that specializes in small business factoring.

Related Articles:

Investor Spotlight: Become a Small Business Funding Specialist!

Small Factor Series – 6 Essential e-Books for Factors and Consultants

Speak Your Mind