Over the past few years I’ve written several articles about starting your own factoring business. Much of the information referred to resources, capital, due diligence and general topics related to the asset based lending industry. To this day I am still amazed over the response we have received on this topic. Today alone I’ve received calls from Europe, Asia and the U.S. about factoring. Since the interest level on this topic has remained so high I felt that it would be a good idea to do a "Best of How To Start A Factoring Business” compiled from previous articles and questions we have received over the last few years. 1. Should I begin as a factoring agent or broker rather than starting a direct funding company? First, understand … [Read more...]

Choosing The Right Factoring Partners

For a factoring broker, selecting the right factoring companies to work with can spell the difference between being successful in the business – and never closing many deals. Yet, most brokers don’t have a well thought out process to choose their factoring partners. Instead, they chose their factors based on the broker compensation package or how well they clicked with their broker representative. While these two criteria are important – they are among the least important criteria to select a factor. Actually, if you select a factor just based on compensation, you could end up losing money. Let me tell you a story. … [Read more...]

Medical Factoring Wears Many Hats

Those of us that call ourselves medical factoring companies may in fact be quite different from one anther. Throughout the years certain niches have been serviced by finance companies all of which are called medical factoring but each focuses on dissimilar asset classes. This discussion is designed to identify these different asset classes within the framework of Medical Factoring, and to provide the broker with a clear understanding of how to find the right financial institution for each. Medical Factoring Wears Many Hats First we can begin with an easily understandable type of medical practice called “dentistry.” Dentists bill the typically recognizable insurance carriers that are associated with healthcare plans and payments. … [Read more...]

Home Health Care Labor Law: Dated or Needed?

A change in labor law has implications for factoring companies and brokers that deal with home care or staffing companies. Once in a while, you come across an article or a news story that really and truly surprises you. The recent NPR article “Home Care Aides Await Decision on New Labor Rules” was one such. It might not sound all that attention grabbing or newsworthy on the surface, but when you have been working with home care agencies for years like … [Read more...]

Friction In The Factoring Industry

Have you ever heard the old saying, “Be careful what you wish for or you might just get it”? It usually refers to the downside of a casually expressed desire. This phrase definitely holds true for anyone who has funded invoices in the factoring industry. We spend so much time on sales and marketing and then it finally happens – we land a new prospect and they complete our application. We hope the prospect will have prefect credit, stellar account debtors, strong financial statements and be free and clear of any liens or judgments. More importantly, we want the deal to glide through the … [Read more...]

How to Optimize and Increase Your Factoring Brokerage Revenues

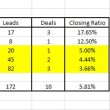

Most factoring brokers are consummate sales professionals who spend their time talking to small business owners and trying to generate leads. Brokerages come in all varieties. Some brokers focus on a single leads source, such as referrals, and work that source for all their leads. Other brokers run more complex businesses that focus on many sales channels at the same time. An example of the … [Read more...]

The Financial Professional’s Vocabulary

It's time for factoring professionals to consider, "What's in your vocabulary?" All of us get caught up in linguistic shorthand that apparently works well between financial professionals in the factoring business but very often becomes a usual and customary part of our parlance. When we talk we have choices of words, phrases and nuances that are available at that time. It is a common mistake (in my view) to use the same choices for all listeners. It is with this in mind that we look at how we use words. Factoring Financial Transactions (Not Deals) My first complaint is with the term “deal.” If one looks through my articles, underwriting notes and comments you can see that I noticeably avoid that word. … [Read more...]

The Affordable Care Act, Medical Staffing and Factoring

A look at what the the Affordable Care Act means to medical staffing and factoring brokers. Love it or loathe it, the Affordable Care Act (ACA) is a reality for businesses. While portions of the bill have been implemented since its 2010 passage, the major provisions don’t take effect until 2014. This year it is important to be in-the-know about how the ACA will impact your business--either that, or get blindsided by penalties and fines. It is also important to keep in mind, though, that anything that creates turmoil also creates opportunity. … [Read more...]

Marketing Your Factoring Business? Avoid The Crush

If you are a regular member of a gym or fitness club as they refer to it today, I always find January to be the most interesting month of the year to be a member. At the beginning of every year the place is so crowded that you usually have to wait in line to use the equipment. Then, within a few weeks the crush subsides and the facility is back to normal. I kind of look at business from the same point view. Just like at the gym, this time of year my mailbox is usually full of emails, blogs and pings from contacts wanting to reconnect to see how we can “align our strategies in a mutually beneficial relationship”. Sound familiar? I’m always amazed by the emails I receive from people who do not know what factoring is and what our … [Read more...]

How To Build Your Factoring Business In 2013

My original discussion was gong to be a year end review of the factoring business, but as we all know it is better to look forward than to look back. So let’s approach this from the prospective of setting up your business for next year. What makes a successful sales effort? The most obvious answer is closing lots of transactions. How do we make that happen? What will make 2013 a successful year for your factoring business? … [Read more...]