When a business is strapped for cash they often turn to factoring accounts receivable as a financing solution. Of course a factoring company expects to earn a profit on the cash advance and charges a fee for their service. Since the overall goal is improved cash flow, a company considering accounts receivable financing will carefully weigh the benefits against the costs. Here are five ways a business can reduce or offset the cost of factoring and still improve cash flow: … [Read more...]

How Can Small Business Turn to Factoring?

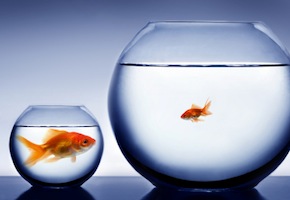

It seems wherever you turn it is difficult for the small business owner to get the same financial flexibility afforded larger companies. More and more small businesses are realizing that the process of factoring is not out of their reach. … [Read more...]