In my early days in the factoring business, prospect calls were few and far between. Whenever the phone rang, I grabbed it quickly and hoped for the best. In those days, the process of qualifying a prospect could take me up to an hour. I would have long detailed conversations, learning everything I could about the client’s business. After these detailed calls, I would hand the client off to the factoring company I thought would help them best. But there were two problems with this strategy. First, it was not a very effective use of my time. Especially when I found out, 45 minutes into a call, that the prospect would not qualify for factoring. And second, it did not scale well. It wasn’t long before I was on the phone eight hours … [Read more...]

Six Tips For A Beginning Factoring Consultant or Broker

If you are new to the factoring industry or are considering becoming a factoring professional, this article is for you. I have been involved in the industry for a decade and through the years have seen a number of consultants do well. However, I have also seen a large number of consultants leave the business – unable to make ends meet. Many of those consultants made critical mistakes that could have been easily corrected. These tips are intended to help you avoid making those mistakes. Tips For Starting as a Factoring Consultant or Broker Tip #1: Know your product This is the cardinal rule for success in any industry. You have to know your product, and know it well. However, most beginning consultants don’t spend enough time … [Read more...]

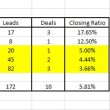

How To Forecast Your Factoring Broker Revenues

In this article you are going to learn about a simple technique to forecast future revenues as a factoring broker based on your existing portfolio of prospects. This technique is useful because it allows you to determine, at the beginning of a month, the approximate revenues that you will earn from your efforts. And more importantly, it helps you evaluate whether your sales efforts are working as well you’d like. Setting up Revenue Tracking This method of forecasting is based on the simple premise that … [Read more...]

Choosing The Right Factoring Partners

For a factoring broker, selecting the right factoring companies to work with can spell the difference between being successful in the business – and never closing many deals. Yet, most brokers don’t have a well thought out process to choose their factoring partners. Instead, they chose their factors based on the broker compensation package or how well they clicked with their broker representative. While these two criteria are important – they are among the least important criteria to select a factor. Actually, if you select a factor just based on compensation, you could end up losing money. Let me tell you a story. … [Read more...]

How to Optimize and Increase Your Factoring Brokerage Revenues

Most factoring brokers are consummate sales professionals who spend their time talking to small business owners and trying to generate leads. Brokerages come in all varieties. Some brokers focus on a single leads source, such as referrals, and work that source for all their leads. Other brokers run more complex businesses that focus on many sales channels at the same time. An example of the … [Read more...]

Using a Factoring Company

One of the most common challenges for companies that work with commercial clients is having to offer credit terms. This gives clients the option to pay an invoice 30 to 60 days after you have delivered your product or provided your services. Your company has to cover the expenses of fulfilling the contract and then wait – for up to two months – to get paid. Offering credit is expensive Most small companies have to offer credit even though they can’t afford it. Large companies demand it and you have to provide it if you want to earn their business. But providing credit has a cost, especially if your company has tight cash flows. At the very least, it will slow down your growth since you won’t be able to add new clients who may also demand … [Read more...]