At some point in our working lives many of us think about starting a business and being our own boss. The thought of … [Read more...]

Using a Factoring Company

One of the most common challenges for companies that work with commercial clients is having to offer credit terms. This gives clients the option to pay an invoice 30 to 60 days after you have delivered your product or provided your services. Your company has to cover the expenses of fulfilling the contract and then wait – for up to two months – to get paid. Offering credit is expensive Most small companies have to offer credit even though they can’t afford it. Large companies demand it and you have to provide it if you want to earn their business. But providing credit has a cost, especially if your company has tight cash flows. At the very least, it will slow down your growth since you won’t be able to add new clients who may also demand … [Read more...]

Medical Coding Factoring Terms

When a medical coding service is considering selling their receivables to a factoring firm, it's important to familiarize themselves with some common factoring terminology. This is a quick reference guide outlining some of the more commonly-used factoring terms to help medical coding business owners navigate seamlessly throughout the entire factoring process. ACH (Automatic Clearing House) - One method factoring companies use to electronically transfer funds into an Account Creditor's account. When an ACH is initiated, the funds are made available electronically in the Account Creditor's account on the next business day. Account Creditor - You, the client and provider of medical coding services. Accounts Receivable - The money … [Read more...]

Learn Factoring – The Alternative Finance Industry Exposed!

Last year small business lending was slashed by over $13 billion dollars and this trend is poised to continue. Join us Tuesday, March 23rd at 2 pm or 9pm EST to discover how to profit with alternative financing. … [Read more...]

Factoring Conference and Workshop Schedule

Searching for training and networking in the accounts receivable factoring industry? The International Factoring Association (IFA) has announced their conference and training courses for 2010. These training courses provide factoring brokers, funders, and investors opportunities for ongoing education and networking in the world of invoice factoring. Mark your calendars for these upcoming events: … [Read more...]

Can a Company Use Accounts Receivable Funding If It Already Has a Bank Line of Credit or Tax Liens?

Many times a company thinks if they have an existing bank loan or line of credit they will not qualify to sell their receivables. In some cases a company may still be eligible to work with a full-service factor and realize the benefits of factoring. … [Read more...]

Factoring Demand Increases as Big Business Takes Longer to Pay

Dealing with cash flow strain in a struggling economy, big business is taking longer to pay on invoices. The average time to pay bills is up 5% to 55.8 days for companies with sales over $5 billion, as reported by the Wall Street Journal in Big Firms Are Quick to Collect, Slow to Pay. … [Read more...]

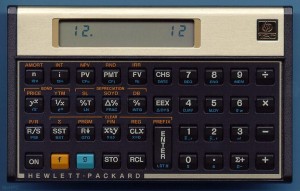

Level the Playing Field by Learning How to Use a Financial Calculator

You may have walked out of meetings with bankers, accountants, and CPA's thinking you were at a "financial disadvantage" as they danced their fingers across a financial calculator and reported their results. You may have even wished you could "crunch the numbers" yourself for peace of mind or to make sure no one was taking advantage of you. If either of those situations sounds familiar, then you need to learn how to use a financial calculator. … [Read more...]

Considering Accounts Receivable Financing? 5 Things to Know Before Applying for Factoring

Factoring provides cash to companies all across America, even when banks say no to business loans. Like all business deals, it pays to be prepared. Save time and money by understanding these 5 areas before … [Read more...]

When Should a Business Use Factoring?

Need to meet payroll? Are suppliers demanding payment? Has the bank reduced or pulled your credit line? These are just a few of the challenges facing businesses in today's economy. In fact over one third of banks surveyed by the Federal Reserve in April 2009 have reported a decline in credit line and credit card limits for businesses. … [Read more...]