A small business owner who is trying to grow his/her business during a booming economy will hit some speed bumps when applying for traditional financing if he/she cannot show an extensive profitable operating history. Throw in the current economic climate, and the chance of an entrepreneur obtaining a conventional bank loan is slim to none. When loans are no longer an option, business owners have to find … [Read more...]

3 Business Factoring Benefits To Grow Your Bottom Line

Although there are many benefits to business factoring over getting a line of credit, consider these… 3 Ways Invoice Financing Can Help Your Business Factoring Benefit #1 - Take On The Slow Payers What?!? Purposely take on accounts that have slow payers? That is right… … [Read more...]

Factoring: Colbert Report Video Reveals Need for Invoice Financing

What’s ailing small business in this recovery? Why aren’t they hiring more people? One major reason…big business is using small business as their banks! The big guys are showing solid returns yet purposely taking longer and longer to pay the invoices owed to small business owners. … [Read more...]

Why Temporary Nurse Staffing Companies Make Great Candidates For Factoring

There are two instances when a temporary nurse staffing agency could encounter a bit of a cash flow crisis. The first is when the agency is just starting out, and the second is when it hits a period of rapid growth. To a bank looking at a loan application, neither situation is attractive. On the contrary, to some factors both of these situations might sound very appealing, and this article explains why. … [Read more...]

Building A Factoring Broker Business? Bigger is Not Always Better!

In my very first sales experience, my book of business was compared to a bathtub half full with water. Additionally, I was told that this bath tub had no plug in the drain, so water was continually escaping from it. The riddle was finally completed with the question, "How therefore can you maintain water in half the tub with the constant outflow of water?" … [Read more...]

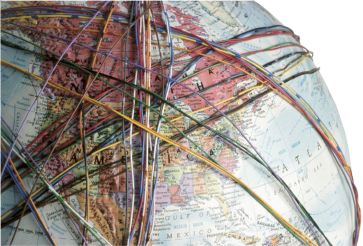

International Factoring Companies

US exports are on the rise leading to increased opportunities for international factoring companies and brokers. In January 2011 exports set a record 167.7 billion up 16% from a year ago and beating the prior high of 165.7 billion in July 2008, according to … [Read more...]

Factoring Your Temporary Staffing Accounts Receivables

Temporary Staffing companies play a key role in employment, and have helped reduce the overall unemployment numbers in the US over the past 6 months, even if their workers are employed on a short-term basis. However, temp staffing is one of the many small business sectors that have been affected by primary lenders who have been forced to tighten credit policies. … [Read more...]

Factoring Medical Receivables – Where are the Needs and Opportunities?

Have you ever known of a situation in which the Federal Government intervened in an industry through regulation or in any other way, and as a result of such intervention, the industry became more efficient? If you can’t think of any off hand it’s because it hasn’t happened. The most recent example of such inefficiency has been the … [Read more...]

Factoring Broker Training – Don’t Make These 3 Mistakes!

Want to earn referral fees as a factoring broker working full or part-time? Be sure to avoid these three common mistakes when seeking prospective clients in need of accounts receivable financing. … [Read more...]

Medical Billing Companies Increase Cash Flow Through Factoring

While the public's confidence on the economy continues to spiral downward, the demand for health care in this country continues to grow. According to the National Coalition on Health Care, the U.S. spent approximately 17% of its GDP in 2008 on health care costs. That percentage is expected to jump to 20% by 2017. … [Read more...]