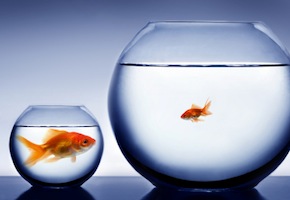

It seems wherever you turn it is difficult for the small business owner to get the same financial flexibility afforded larger companies. More and more small businesses are realizing that the process of factoring is not out of their reach. … [Read more...]

Factors and Asset Based Lenders Fill Bank Financing Void

The results are in and the numbers show what many of us were already seeing, factoring and asset based lending are on the increase. Amazingly, factoring has experienced continued growth for the past 33 years in every year except 2001. Just take a quick look at these highlights … [Read more...]

Delinquent Debt How to Make Good Money With Bad Debt!

For better or worse, the United States economy runs on debt. In fact consumer credit alone totals over 2.4 trillion dollars (Federal Reserve August 2009 statistical release). That doesn't even include the big-ticket items like mortgages, commercial debt, and business loans! Now think about the state of the economy and the never ending reports on delinquencies, slow pays, and bad debt. If you are looking for the opportunity in this dismal economy.... think delinquent debt! Sound crazy? Think it through: … [Read more...]

Investor Spotlight: Healthcare Factoring with PRN Funding!

Factoring account receivables is helping health care companies through these tough economic conditions opening the door to earning opportunities for cash flow consultants. FactoringInvestor (FI) caught up with Phil Cohen, Founder and President of PRN Funding, LLC, to fill us in on the specialized niche of healthcare funding. … [Read more...]

What’s the Difference Between Factoring and Asset Based Lending?

Companies in need of creative working capital solutions often consider both Asset Based Lending and Factoring. This leaves many businesses to wonder, "What's the difference? Is it really apples and oranges?" … [Read more...]

An Alternative to Factoring

How can a business turn their account receivables to cash when they want to avoid factoring? Here is an alternative solution to consider when a company does not want to discount invoices or doesn't qualify for factoring. … [Read more...]

Investor Spotlight: It’s Not Just Construction Factoring with Quantum Corporate Funding

Factoring account receivables is helping businesses through these tough economic conditions opening the door to earning opportunities for cash flow consultants. FactoringInvestor (FI) caught up with Howard Chernin (HC) to fill us in on the accounts receivable funding business. … [Read more...]

When Should a Business Use Factoring?

Need to meet payroll? Are suppliers demanding payment? Has the bank reduced or pulled your credit line? These are just a few of the challenges facing businesses in today's economy. In fact over one third of banks surveyed by the Federal Reserve in April 2009 have reported a decline in credit line and credit card limits for businesses. … [Read more...]

What is Spot Factoring?

Need a quick one-time infusion of cash for your company? Spot factoring just might be the answer. This business financing solution enables a company to receive an advance on a single outstanding invoice. … [Read more...]

Learn to Factor Government Receivables

The federal government is spending more than ever in the struggling economy with government contracts on the rise. Contractors working with the government are eager to access working capital by factoring government receivables. The International Factoring Association is offering a training class on Factoring Government Receivables. The two-day event will be October 15 & 16, 2009, at the Mandalay Bay Hotel in Las Vegas, NV. Kwesi Rogers, Principal and President of Federal National Payables, Inc., will be one of the lead instructors. He has financed over 200 small and emerging government contractors and offers insight on how to successfully factor government receivables. Registration is available online through factoring.org … [Read more...]