A common question among companies is whether they should pursue bank factoring or deal with a company that specializes in factoring when deciding to sell account receivables. … [Read more...]

Can a Company Use Accounts Receivable Funding If It Already Has a Bank Line of Credit or Tax Liens?

Many times a company thinks if they have an existing bank loan or line of credit they will not qualify to sell their receivables. In some cases a company may still be eligible to work with a full-service factor and realize the benefits of factoring. … [Read more...]

Factoring Demand Increases as Big Business Takes Longer to Pay

Dealing with cash flow strain in a struggling economy, big business is taking longer to pay on invoices. The average time to pay bills is up 5% to 55.8 days for companies with sales over $5 billion, as reported by the Wall Street Journal in Big Firms Are Quick to Collect, Slow to Pay. … [Read more...]

Don’t Factor Your Receivables When.

Small business owners are no strangers to watching every dollar. When a customer is late to pay an invoice the business feels it. This leaves many owners losing sleep and making … [Read more...]

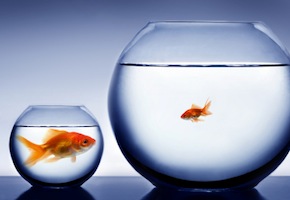

Attention Business Owners! Stop Being a Part-Time Banker for Your Customers

How many customers take longer than 30 days to pay on their invoices? Congratulations! Your business has just extended credit to your customers. You may not have thought about it this way, but you are now in the banking business. Even worse, you probably have the best rates in town. … [Read more...]

Five Strategies to Reduce Factoring Costs

When a business is strapped for cash they often turn to factoring accounts receivable as a financing solution. Of course a factoring company expects to earn a profit on the cash advance and charges a fee for their service. Since the overall goal is improved cash flow, a company considering accounts receivable financing will carefully weigh the benefits against the costs. Here are five ways a business can reduce or offset the cost of factoring and still improve cash flow: … [Read more...]

How Can Small Business Turn to Factoring?

It seems wherever you turn it is difficult for the small business owner to get the same financial flexibility afforded larger companies. More and more small businesses are realizing that the process of factoring is not out of their reach. … [Read more...]

Investor Spotlight: Healthcare Factoring with PRN Funding!

Factoring account receivables is helping health care companies through these tough economic conditions opening the door to earning opportunities for cash flow consultants. FactoringInvestor (FI) caught up with Phil Cohen, Founder and President of PRN Funding, LLC, to fill us in on the specialized niche of healthcare funding. … [Read more...]

Investor Spotlight: It’s Not Just Construction Factoring with Quantum Corporate Funding

Factoring account receivables is helping businesses through these tough economic conditions opening the door to earning opportunities for cash flow consultants. FactoringInvestor (FI) caught up with Howard Chernin (HC) to fill us in on the accounts receivable funding business. … [Read more...]

How to Be a Small Business Factoring Specialist!

Dash Point Financial has become a well-known specialist in small business factoring with over 15 years of industry success. Factoring Investor (FI) asked Jeff Callender, founder and president, to share some information on working with his company. … [Read more...]