Many companies that start using factoring often have questions regarding their customers. How will they be treated? What if they pay me directly? What do I tell them? Here are some common questions and helpful answers. … [Read more...]

Bank Factoring or a Factoring Company?

A common question among companies is whether they should pursue bank factoring or deal with a company that specializes in factoring when deciding to sell account receivables. … [Read more...]

Factoring FAQs

Ok, you are considering factoring and you are busy. You are not looking to read volumes of factoring manuals or sit through a weekend seminar. You just want the 60 second big picture overview. Well, this article is for you! … [Read more...]

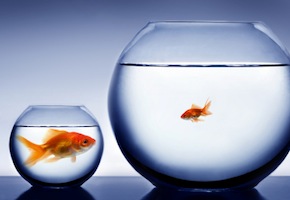

Attention Business Owners! Stop Being a Part-Time Banker for Your Customers

How many customers take longer than 30 days to pay on their invoices? Congratulations! Your business has just extended credit to your customers. You may not have thought about it this way, but you are now in the banking business. Even worse, you probably have the best rates in town. … [Read more...]

Five Strategies to Reduce Factoring Costs

When a business is strapped for cash they often turn to factoring accounts receivable as a financing solution. Of course a factoring company expects to earn a profit on the cash advance and charges a fee for their service. Since the overall goal is improved cash flow, a company considering accounts receivable financing will carefully weigh the benefits against the costs. Here are five ways a business can reduce or offset the cost of factoring and still improve cash flow: … [Read more...]

How Can Small Business Turn to Factoring?

It seems wherever you turn it is difficult for the small business owner to get the same financial flexibility afforded larger companies. More and more small businesses are realizing that the process of factoring is not out of their reach. … [Read more...]

Factors and Asset Based Lenders Fill Bank Financing Void

The results are in and the numbers show what many of us were already seeing, factoring and asset based lending are on the increase. Amazingly, factoring has experienced continued growth for the past 33 years in every year except 2001. Just take a quick look at these highlights … [Read more...]

What’s the Difference Between Factoring and Asset Based Lending?

Companies in need of creative working capital solutions often consider both Asset Based Lending and Factoring. This leaves many businesses to wonder, "What's the difference? Is it really apples and oranges?" … [Read more...]

Investor Spotlight: It’s Not Just Construction Factoring with Quantum Corporate Funding

Factoring account receivables is helping businesses through these tough economic conditions opening the door to earning opportunities for cash flow consultants. FactoringInvestor (FI) caught up with Howard Chernin (HC) to fill us in on the accounts receivable funding business. … [Read more...]

Learn to Factor Government Receivables

The federal government is spending more than ever in the struggling economy with government contracts on the rise. Contractors working with the government are eager to access working capital by factoring government receivables. The International Factoring Association is offering a training class on Factoring Government Receivables. The two-day event will be October 15 & 16, 2009, at the Mandalay Bay Hotel in Las Vegas, NV. Kwesi Rogers, Principal and President of Federal National Payables, Inc., will be one of the lead instructors. He has financed over 200 small and emerging government contractors and offers insight on how to successfully factor government receivables. Registration is available online through factoring.org … [Read more...]