Ok, you are considering factoring and you are busy. You are not looking to read volumes of factoring manuals or sit through a weekend seminar. You just want the 60 second big picture overview. Well, this article is for you! … [Read more...]

How To Make Money and Earn Fees in the Cash Flow Business!

Many people have heard about the cash flow industry but don't really know how the average person can profit from it. There are basically three methods for handling the fees paid to cash flow brokers or consultants, as follows: Referral Fee Establish Your Own Fee Set Commission Fee 1. Referral Fee Pros: Very Little Paperwork/Time. Cons: Typically smaller commissions. Cash Flows: Just about any cash flow can be "referred." The Referral Fee structure is the easiest, particularly if you already have a full time job and you have limited extra hours in the day. With the Referral Fee structure you simply find a deal and refer it on to a Funder or Master Consultant that accepts referrals. For the most part, you have no or … [Read more...]

Can a Company Use Accounts Receivable Funding If It Already Has a Bank Line of Credit or Tax Liens?

Many times a company thinks if they have an existing bank loan or line of credit they will not qualify to sell their receivables. In some cases a company may still be eligible to work with a full-service factor and realize the benefits of factoring. … [Read more...]

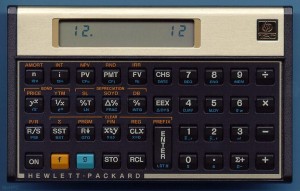

Level the Playing Field by Learning How to Use a Financial Calculator

You may have walked out of meetings with bankers, accountants, and CPA's thinking you were at a "financial disadvantage" as they danced their fingers across a financial calculator and reported their results. You may have even wished you could "crunch the numbers" yourself for peace of mind or to make sure no one was taking advantage of you. If either of those situations sounds familiar, then you need to learn how to use a financial calculator. … [Read more...]

Don’t Factor Your Receivables When.

Small business owners are no strangers to watching every dollar. When a customer is late to pay an invoice the business feels it. This leaves many owners losing sleep and making … [Read more...]

How Can Small Business Turn to Factoring?

It seems wherever you turn it is difficult for the small business owner to get the same financial flexibility afforded larger companies. More and more small businesses are realizing that the process of factoring is not out of their reach. … [Read more...]

Single Invoice Factoring Provides Cash Flow for Small Businesses

FROM MARKETWIRE May 13, 2009 BETHESDA, MD The Interface Financial Group (IFG), North America's largest alternative funding source for small business, reports instances where invoice factoring, when a business sells its accounts receivable invoices at a discount, has helped a company stay in business in the midst of the current global economic downturn. A recent report by BizBuySell.com, which tracks the health of small business, indicates that there has been a decline in business-for-sale transactions and valuations. Additionally, the number of closed transactions reported in the first quarter decreased by 36 percent as compared to the same 2008 time period. As many small business owners across the country are struggling, many … [Read more...]

Marketing – If the Phone Does Not Ring, Nothing Else Matters

No matter what industry you are in, it is easy to get bogged down with the little things. Some people are so focused on their business name, business cards, stationary, website, and office furniture, they forget the biggest goal; Getting the Phone to Ring! … [Read more...]

Factoring – The “F” is for Flexibility

There are a lot of misconceptions about Factoring accounts receivable. The two biggest myths are It Costs Too Much and Lack of Flexibility. That may have been true in "the old days" but nothing could be further from the truth today. … [Read more...]

What is Freight Bill Factoring?

There are many businesses that outlay cash in advance of getting paid. One of the most cash flow strapped businesses is the trucking industry. Even though freight companies usually operate with significant profit margins, they have a substantial amount of cash outlay to deliver goods. Expenses include truck repairs, fuel, and even rentals; and no amount of profit helps when you are still waiting to get paid. … [Read more...]