Utah based factoring company AAA Factoring, which is owned by 71 year old amputee, helps small businesses get the financing they need to operate while pledging 5% of company profits to help Haitian amputees. MAY 4, 2010 -- CENTERVILLE, Utah -- AAA Factoring announced today that beginning June 1, 2010, 5% of the company profits will be donated to charities that help Haitian amputees that lost their limbs in the recent earthquake. The company is owned and operated by Duane H. Marchant who is an amputee himself. Duane lost his right leg after a fluke accident and several failed surgical attempts to save his leg. … [Read more...]

Medical Coding Factoring Terms

When a medical coding service is considering selling their receivables to a factoring firm, it's important to familiarize themselves with some common factoring terminology. This is a quick reference guide outlining some of the more commonly-used factoring terms to help medical coding business owners navigate seamlessly throughout the entire factoring process. ACH (Automatic Clearing House) - One method factoring companies use to electronically transfer funds into an Account Creditor's account. When an ACH is initiated, the funds are made available electronically in the Account Creditor's account on the next business day. Account Creditor - You, the client and provider of medical coding services. Accounts Receivable - The money … [Read more...]

Why Use Spot Factoring?

Spot factoring lets a business raise working capital by receiving an advance on just a single outstanding invoice. Here are 3 reasons it is effective to offer spot factoring to clients, as shared by Steve Ontiveros of Resource Business Partners, Inc. … [Read more...]

Factoring Conference and Workshop Schedule

Searching for training and networking in the accounts receivable factoring industry? The International Factoring Association (IFA) has announced their conference and training courses for 2010. These training courses provide factoring brokers, funders, and investors opportunities for ongoing education and networking in the world of invoice factoring. Mark your calendars for these upcoming events: … [Read more...]

How To Make Money and Earn Fees in the Cash Flow Business!

Many people have heard about the cash flow industry but don't really know how the average person can profit from it. There are basically three methods for handling the fees paid to cash flow brokers or consultants, as follows: Referral Fee Establish Your Own Fee Set Commission Fee 1. Referral Fee Pros: Very Little Paperwork/Time. Cons: Typically smaller commissions. Cash Flows: Just about any cash flow can be "referred." The Referral Fee structure is the easiest, particularly if you already have a full time job and you have limited extra hours in the day. With the Referral Fee structure you simply find a deal and refer it on to a Funder or Master Consultant that accepts referrals. For the most part, you have no or … [Read more...]

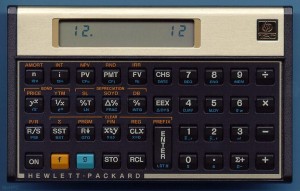

Level the Playing Field by Learning How to Use a Financial Calculator

You may have walked out of meetings with bankers, accountants, and CPA's thinking you were at a "financial disadvantage" as they danced their fingers across a financial calculator and reported their results. You may have even wished you could "crunch the numbers" yourself for peace of mind or to make sure no one was taking advantage of you. If either of those situations sounds familiar, then you need to learn how to use a financial calculator. … [Read more...]

Small Business Factoring Success Story

Do you ever wonder what people who are now factors used to do before they became factors? The diversity in backgrounds is fascinating and in this article, small factor Jeff Callender chats with colleague Don D'Ambrosio of Oxygen Funding, Inc, and uncovers some intriguing personal, and national, history. Jeff Callender: As an author and trainer of small factors, over the past year I have received many phone calls from people presently or formerly working in the mortgage industry who have been considering factoring as a new career. I realized it would be both interesting and educational to have a conversation with someone once involved in the mortgage industry for many years, and who made the jump. In this interview you'll find his … [Read more...]

Delinquent Debt How to Make Good Money With Bad Debt!

For better or worse, the United States economy runs on debt. In fact consumer credit alone totals over 2.4 trillion dollars (Federal Reserve August 2009 statistical release). That doesn't even include the big-ticket items like mortgages, commercial debt, and business loans! Now think about the state of the economy and the never ending reports on delinquencies, slow pays, and bad debt. If you are looking for the opportunity in this dismal economy.... think delinquent debt! Sound crazy? Think it through: … [Read more...]

Learn to Factor Government Receivables

The federal government is spending more than ever in the struggling economy with government contracts on the rise. Contractors working with the government are eager to access working capital by factoring government receivables. The International Factoring Association is offering a training class on Factoring Government Receivables. The two-day event will be October 15 & 16, 2009, at the Mandalay Bay Hotel in Las Vegas, NV. Kwesi Rogers, Principal and President of Federal National Payables, Inc., will be one of the lead instructors. He has financed over 200 small and emerging government contractors and offers insight on how to successfully factor government receivables. Registration is available online through factoring.org … [Read more...]