As a factoring broker, you have the opportunity to work with both factoring companies and businesses looking for funding. This requires plenty of time, effort, expertise in an assortment of industries, and a knack for relationship building. Without a doubt, it’s hard work to become a successful factoring broker. Here are 5 things successful factoring brokers do to lay the foundation for a profitable operation. 1. Never Stop Learning Factoring brokers should always stay up to date on the factoring industry, marketing trends, technology, competitors, and current events. Success comes to active learners who are open to new experiences and willing to seek or create opportunities for growth. Build relationships with other factoring experts … [Read more...]

Search Results for: marketing

How I Sell. My Preferred Factoring Sales Technique

Selling factoring services can be very challenging, especially in this environment where there is very strong competition. Not only do you have to help clients determine if factoring is right for them, you also have to show them how your solution is better for them that everyone else’s. This may sound simple, but selling factoring services in this market is very difficult. It’s a crowded market with every factoring company promoting their benefits. You can expect that most prospects will be talking to four or five different factors. One simple approach is to match what they are saying. But if you do that, you become a “me too!” factoring provider that will only get average results. So, how do you break through that barrier? How do … [Read more...]

The Do’s and Don’ts of Factoring Trade Shows

It’s that time of the year again… tradeshow season is upon us. Tradeshow exhibiting is a great way to attract new factoring business, but it’s also time consuming and expensive. Since relationship building is hard to quantify, sometimes it’s difficult to determine the value of attending industry shows or marketing events. PRN Funding has attended many shows across various industries. Based on our experience, we have compiled a list of trade show do’s and don’ts to help make your next trade show exhibit a rewarding experience. Do... Research Ask questions before considering any trade show. What’s the audience demographic? What types of companies will be exhibiting? How will the trade show contribute to business goals? Being … [Read more...]

Factoring Brokers Unite!

We have all heard the expression that “half of something is better than all of nothing.” Along with that as a “given,” let’s also realize that we all have our strengths and weaknesses. The combination of these two statements leads us to a discussion on how and why factoring brokers can join forces with others. Many financial consultants have contacted us asking about ideas for marketing their factoring businesses. Of course, we provide as much help to our brokers as we can so we go through the entire litany of ideas and strategies. All aspects are discussed and responses generally vary. We’ve heard “No, I don’t like networking events because I’m shy.” Another common response is “I do not do phone cold calls.” Still another one is “I … [Read more...]

Best of How To Start A Factoring Business

Over the past few years I’ve written several articles about starting your own factoring business. Much of the information referred to resources, capital, due diligence and general topics related to the asset based lending industry. To this day I am still amazed over the response we have received on this topic. Today alone I’ve received calls from Europe, Asia and the U.S. about factoring. Since the interest level on this topic has remained so high I felt that it would be a good idea to do a "Best of How To Start A Factoring Business” compiled from previous articles and questions we have received over the last few years. 1. Should I begin as a factoring agent or broker rather than starting a direct funding company? First, understand … [Read more...]

Friction In The Factoring Industry

Have you ever heard the old saying, “Be careful what you wish for or you might just get it”? It usually refers to the downside of a casually expressed desire. This phrase definitely holds true for anyone who has funded invoices in the factoring industry. We spend so much time on sales and marketing and then it finally happens – we land a new prospect and they complete our application. We hope the prospect will have prefect credit, stellar account debtors, strong financial statements and be free and clear of any liens or judgments. More importantly, we want the deal to glide through the … [Read more...]

How to Optimize and Increase Your Factoring Brokerage Revenues

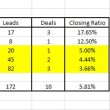

Most factoring brokers are consummate sales professionals who spend their time talking to small business owners and trying to generate leads. Brokerages come in all varieties. Some brokers focus on a single leads source, such as referrals, and work that source for all their leads. Other brokers run more complex businesses that focus on many sales channels at the same time. An example of the … [Read more...]

Delinquent Debt: A Broker’s Manual

For better or worse, the United States economy runs on debt. In fact consumer credit alone totals over 2.4 trillion dollars (Federal Reserve August 2009 statistical release). That doesn't even include the big-ticket items like mortgages, commercial debt, and business loans! Now think about the state of the economy and the never ending reports on delinquencies, slow pays, and bad debt. If you are looking for the opportunity in this dismal economy.... think delinquent debt! Sound crazy? Think it through: What do all businesses have in common? What do all businesses have whether they want it or not? What would all businesses love to get rid of? What is worth money to a business, and yet they often just throw it away? You … [Read more...]

How I Run My One Person Factoring Business

Have you wondered what it takes to run a small factoring business by yourself or with just a family member? What do you need for day-to-day operations in terms of equipment, technology, documentation, and know-how? Factoring receivables can be a lucrative business with high returns, but you need to know how to manage the business with minimal overhead. Overseeing employees adds significant additional costs and responsibilities. This informative ebook is written in the first-person by Jeff Callender, a well-respected small invoice factor who has been in the business since the mid-90s. Jeff shows simply and clearly how he has run his company year after year with no employees. Discover how his use of current technology, … [Read more...]