A common question among companies is whether they should pursue bank factoring or deal with a company that specializes in factoring when deciding to sell account receivables. … [Read more...]

Archives for 2009

Factoring FAQs

Ok, you are considering factoring and you are busy. You are not looking to read volumes of factoring manuals or sit through a weekend seminar. You just want the 60 second big picture overview. Well, this article is for you! … [Read more...]

How To Make Money and Earn Fees in the Cash Flow Business!

Many people have heard about the cash flow industry but don't really know how the average person can profit from it. There are basically three methods for handling the fees paid to cash flow brokers or consultants, as follows: Referral Fee Establish Your Own Fee Set Commission Fee 1. Referral Fee Pros: Very Little Paperwork/Time. Cons: Typically smaller commissions. Cash Flows: Just about any cash flow can be "referred." The Referral Fee structure is the easiest, particularly if you already have a full time job and you have limited extra hours in the day. With the Referral Fee structure you simply find a deal and refer it on to a Funder or Master Consultant that accepts referrals. For the most part, you have no or … [Read more...]

Can a Company Use Accounts Receivable Funding If It Already Has a Bank Line of Credit or Tax Liens?

Many times a company thinks if they have an existing bank loan or line of credit they will not qualify to sell their receivables. In some cases a company may still be eligible to work with a full-service factor and realize the benefits of factoring. … [Read more...]

Factoring Demand Increases as Big Business Takes Longer to Pay

Dealing with cash flow strain in a struggling economy, big business is taking longer to pay on invoices. The average time to pay bills is up 5% to 55.8 days for companies with sales over $5 billion, as reported by the Wall Street Journal in Big Firms Are Quick to Collect, Slow to Pay. … [Read more...]

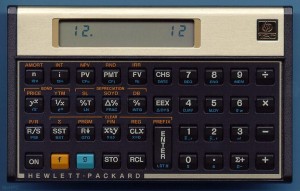

Level the Playing Field by Learning How to Use a Financial Calculator

You may have walked out of meetings with bankers, accountants, and CPA's thinking you were at a "financial disadvantage" as they danced their fingers across a financial calculator and reported their results. You may have even wished you could "crunch the numbers" yourself for peace of mind or to make sure no one was taking advantage of you. If either of those situations sounds familiar, then you need to learn how to use a financial calculator. … [Read more...]

Considering Accounts Receivable Financing? 5 Things to Know Before Applying for Factoring

Factoring provides cash to companies all across America, even when banks say no to business loans. Like all business deals, it pays to be prepared. Save time and money by understanding these 5 areas before … [Read more...]

Don’t Factor Your Receivables When.

Small business owners are no strangers to watching every dollar. When a customer is late to pay an invoice the business feels it. This leaves many owners losing sleep and making … [Read more...]

Attention Business Owners! Stop Being a Part-Time Banker for Your Customers

How many customers take longer than 30 days to pay on their invoices? Congratulations! Your business has just extended credit to your customers. You may not have thought about it this way, but you are now in the banking business. Even worse, you probably have the best rates in town. … [Read more...]

Small Business Factoring Success Story

Do you ever wonder what people who are now factors used to do before they became factors? The diversity in backgrounds is fascinating and in this article, small factor Jeff Callender chats with colleague Don D'Ambrosio of Oxygen Funding, Inc, and uncovers some intriguing personal, and national, history. Jeff Callender: As an author and trainer of small factors, over the past year I have received many phone calls from people presently or formerly working in the mortgage industry who have been considering factoring as a new career. I realized it would be both interesting and educational to have a conversation with someone once involved in the mortgage industry for many years, and who made the jump. In this interview you'll find his … [Read more...]